The Federal Reserve Faces Difficult Decisions: Why Rate Hikes Are on the Horizon

With high inflation and a tight labor market, the Federal Reserve must prioritize stability over short-term relief, making rate hikes essential.

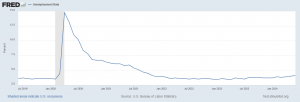

Low Unemployment: A Double-Edged Sword

The U.S. economy is experiencing historically low unemployment rates, suggesting that the labor market is near or at full employment. While this is typically a positive indicator, it also creates upward pressure on wages. As employers compete for a limited pool of workers, they are forced to offer higher wages, which can contribute to inflation. This wage-driven inflation is a significant concern for the Fed, as it can lead to a cycle of rising prices and increased wage demands.

Persistent High Inflation

Despite some claims of transitory inflation, recent data indicates that inflation remains stubbornly high, well above the Fed’s 2% target. This sustained inflation is not just a result of temporary supply chain issues but is also driven by strong consumer demand. Lowering interest rates could further fuel this demand, leading to even higher inflationary pressures. The Fed’s primary tool to combat inflation is to raise interest rates, which can help cool down an overheated economy by making borrowing more expensive and saving more attractive.

Consumer Spending and Supply Chain Disruptions

The U.S. economy has seen robust consumer spending, partially driven by the low interest rates that have been in place since the beginning of the COVID-19 pandemic. While consumer spending is a critical component of economic growth, excessive spending can lead to demand-pull inflation. Additionally, global supply chain disruptions continue to affect the availability of goods, contributing to higher prices. Monetary policy cannot address these supply-side issues alone, but lowering rates would likely exacerbate the situation by increasing demand for scarce goods.

Global Economic Conditions

The Fed must also consider the broader global economic environment. Geopolitical tensions, such as those involving major trading partners, and economic instability in various regions, add layers of complexity to the Fed's decision-making process. In such a volatile global landscape, maintaining higher interest rates can provide a buffer against external shocks and help stabilize the U.S. economy.

Long-Term Economic Stability

One of the Fed's primary goals is to ensure long-term economic stability. While lowering rates might offer short-term economic relief, it could lead to significant long-term challenges, including runaway inflation and asset bubbles. By maintaining or even raising rates, the Fed aims to prevent these potential pitfalls and foster a more sustainable economic environment.

Market Expectations

Financial markets closely monitor the Fed's actions and signals. A commitment to controlling inflation through rate hikes can stabilize market expectations and reduce uncertainty. This stability is crucial for long-term investment and economic planning.

Conclusion

In summary, the Federal Reserve faces a complex economic landscape where the risks of lowering interest rates outweigh the potential benefits. With low unemployment, persistently high inflation, robust consumer spending, global economic uncertainties, and the need for long-term stability, the Fed is likely to continue its cautious stance on interest rates. Rate hikes may indeed be on the horizon as the Fed strives to balance these competing pressures and maintain economic equilibrium.

What are your thoughts on the Fed's current monetary policy? The debate continues as we navigate these challenging economic times.

Clem Ziroli III

Clem Ziroli III

+1 702-906-9932

email us here

Visit us on social media:

X

LinkedIn

Instagram

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.