1% FLAT TAX SYSTEM Will Stop The Debt Clock

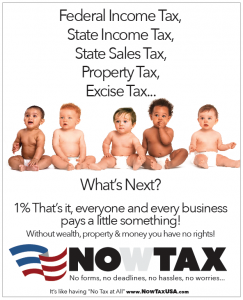

Now Tax USA announces the 1% Flat Tax System proposed Amendment/Bill is the only tax system that can start to pay down the National Debt.

The Now Tax Formula™ 1% Flat Tax is; The first and only A-political (non-partisan) sole/single tax collection system (with the least amount of rules, regulations, and laws) that spreads the cost of the federal tax budget (infrastructure, government expenses, debt, entitlements, and benefits) over all segments of the economy using the largest common denominator (all the total sales, and transactions of all segments of the economy-TEST) divided into the federal budget to determine and create the lowest possible tax rate; to have little or no negative effect on the economy. The largest common denominator means all sales and all transactions from all segments of the economy: all citizens, non-citizens, consumers, organizations, enterprises, and businesses. (Excluding internal transfers of personal or business transactions).

It is undeniable and impossible for the current income tax system or other proposed progressive consumer sales tax systems to collect enough taxes to keep up with the needs of our nation. Ever-larger demands for infrastructure and government services will require a tax system that collects enough taxes to balance the budget, pay down the debt, and while benefiting the economy.

NOW-TAX Features and Benefits:

1. The sole and only tax collection system for "All Segments of the Economy" (ASOE); no other taxes.

2. The lowest tax rate possible.

3. The easiest tax to administer and collect, with the least number of rules, laws, and regulations. A pay-as-you-go tax system.

4. A tax system that spreads the tax burden evenly and fairly across all citizens, non-citizens, businesses, enterprises, and organizations – ASOE. A tax system

5. That never singles out any one segment of the economy.

6. A tax that creates maximum cash flow for the economy.

7. A tax that will collect enough funds to maintain a balanced budget.

8. A tax that eliminates the underground economy.

9. A tax that will start to pay down our national debt.

10. First tax system to create a Tax Bill Of Rights.

11. A tax that will unleash the wealth of the United States to be the most competitive economy in the world.

Stephen Redden

Now Tax USA

+1 727-776-3316

email us here

Visit us on social media:

Twitter

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.