Estimates for US economic growth in the second quarter continue to project a strong rebound following Q1’s subdued gain. But the upbeat outlook may falter in the second half of the year if the White House’s tough talk on trade policy is implemented and China responds in kind.

Tensions over trade policy between the world’s two largest economies have intensified this week. President Trump on Monday announced he was considering a new 10% tariff on $200 billion of Chinese goods and Beijing quickly responded that it would retaliate.

Although the immediate effects of an escalating trade battle would be limited for the US economy, the potential for stronger headwinds can’t be ruled out, depending on how the clash between the two countries plays out. The worst-case scenario for the US: new tariffs on Chinese imports rise to a degree that dampens consumer spending (and economic growth overall) while raising inflation.

“In a global trade war, no matter how you spin tariffs, retailers and the American families that we serve are the losers,” says Hun Quach, vice president, international trade, for the Retail Industry Leaders Association.

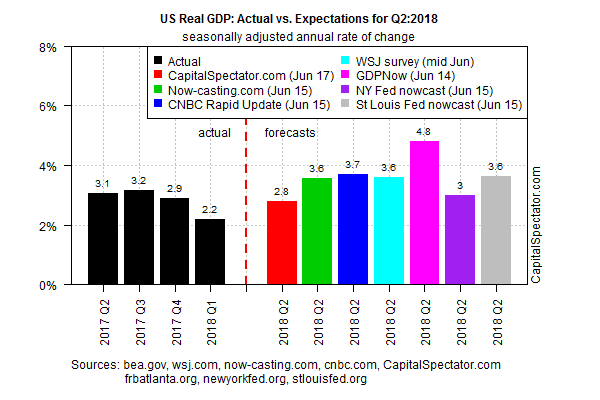

Meanwhile, the current profile of the US economy reflects solid growth, based on the latest estimates of GDP activity for Q2. The median projection of several forecasts compiled by The Capital Spectator points to a 3.6% increase in output ((seasonally adjusted annual rate), up sharply from the 2.2% rise in Q1. The Bureau of Economic Analysis is scheduled to publish its initial GDP report for the second-quarter on July 27.

The current median 3.6% Q2 estimate for GDP growth ticked down slightly from the projection earlier in the month. But it’s fair to say that the outlook for a robust rebound following Q1 has held steady in recent weeks.

The question is whether forecasters will start to trim their rosy estimates as trade tensions mount? Stephen Gallagher, managing director of Société Générale (PA:SOGN), is maintaining an optimistic view, at least for now. “Certainly in some industries, or good by good, [the blowback from trade tariffs] has some material effect,” he explains. “In my view it’s still not a macro event, though it could develop to that…right now it’s still more of a temper tantrum on trade, as opposed to a real war.”

Unsurprisingly, White House Council of Economic Advisers Chairman Kevin Hassett is also inclined to favor a positive spin on the latest developments. “When uncertainty is high, that’s difficult for Americans, and it does depress activity a little bit,” Hassett said in an interview on Monday. “If right in the middle of a financial crisis we added some uncertainty over exactly how are these negotiations going to work out, then it would be pretty harmful then. But right now the economy has got a lot of forward momentum.”

True, but it’s unclear if that forward momentum will endure in a US-China trade war.

“Just talking about protectionism is causing trouble,” notes Marie Owens Thomsen, global chief economist at Indosuez Wealth Management in Geneva. “It’s an existential risk to the world economy.”