Pensions timebomb: Workers will have to pay 5pc of salary in new scheme - OECD

Workers will have to pay 5pc of salary for pension - but employers will have to match it

A major international study by the OECD has found the average Irish worker’s pension is worth just 34pc of their earnings because of the lack of provision beyond the basic State pension. Stock photo

Workers face paying 5pc of their salary from their 20s onwards to help defuse the pensions timebomb, which has left Irish people with some of the worst entitlements in the developed world.

Employers would also be expected to match the 5pc contribution to boost the pension pots of all workers under a new mandatory scheme.

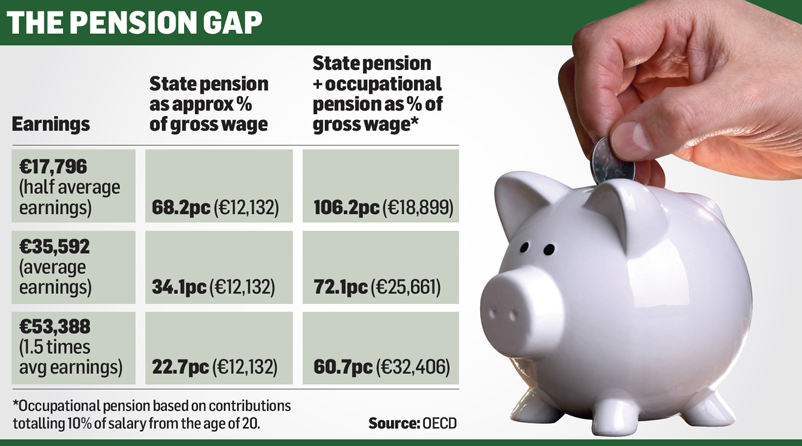

A major study by the OECD has found that the average Irish worker's pension is worth just 34pc of their earnings because of the lack of provision beyond the basic State pension.

Two-thirds of private sector workers have no occupational pension to supplement their State pension and many will face hardship in old age.

However, a new scheme, in which workers would be automatically enrolled, is being planned by the Government.

The OECD said pensions could be more than doubled under this type of mandatory scheme, but it would not come without significant cost throughout a person's career.

Click to view full size graphic

OECD economist Boele Bonthuis said a contribution worth 10pc of pay would have to be made by someone aged 20 entering the labour market now to achieve this result - and the contribution could be divided in any way between workers and employers.

The OECD report showed the average worker on €35,592 a year gets a State pension worth just 34pc of their earnings.

By comparison, the average OECD worker gets a pension worth almost 53pc of their wages, while the rate is 58pc among the EU28.

But if the average worker had an occupational pension as well, they would end up with a much more healthy pension worth 72pc of their earnings - equal to €25,661 a year.

For the squeezed middle worker on a salary of €53,388, the State pension is worth just under 23pc of their earnings.

The report found this group suffers one of the biggest falls in income across the world when they retire. The only other nations where this type of earners take such a hit when they retire are Mexico, New Zealand, Switzerland and the UK.

However, the effect of an additional scheme would mean they got 61pc of their earnings, or €32,406. Meanwhile, the lower-paid would enjoy a pension boost worth 106pc of their earnings, or €18,899 a year.

"This gives some indication of the effect of making occupational pensions mandatory," said Mr Bonthuis.

He said the tendency in OECD countries when funded occupational schemes were set up was to introduce them as defined contribution schemes - already the norm here.

Points

'Pensions at a Glance 2017' revealed that Ireland and New Zealand are the only OECD countries with no mandatory, second-tier pension provision.

In the other 33 countries, there are four kinds of schemes, varying from defined benefit and defined contribution plans to notional accounts schemes and points schemes, where workers earn pension points based on their earning.

Taoiseach Leo Varadkar promised an automatic enrolment scheme could be in place by 2021 in his previous role as social protection minister. A portion of a worker's pay would automatically be directed into a pension fund, although they could opt out.

A five-year pension reform plan will be rolled out in the near future, during which the fine detail of the proposed automatic enrolment scheme is due to be hammered out.

A department spokesperson stressed that decisions on what the contribution requirements will be, and other key details, have yet to be made.

Further public consultation will be undertaken before decisions are made.

They added: “Further detailed evidence building and consultation will be undertaken to inform fundamental choices which are required regarding the preferred operational structure and organisational governance for a new system as well as many design elements such as contribution levels, financial incentives and target membership.”

Such a scheme was set up in the UK in 2012. It has been hailed a success on the whole, but criticised for holding back wage rises in some cases. Almost 90pc of those enrolled have chosen not to opt out.

Join the Irish Independent WhatsApp channel

Stay up to date with all the latest news